An Outstanding Offer on the Citi AA Platinum Select

Tl;dr: A useful card for AA travelers and a fast track to free travel for anyone.

American Airlines is somewhat unique in that, now that it no longer partners with Bilt, there’s no credit card points available that can be transferred to AA, but there are two banks that offer co-branded AA cards: Citi and Barclays. I’ve written about the Barclays Aviator card before, and how it got us to Japan, but the latest welcome offer from Citi demands that I write a bit about the AAdvantage Platinum Select.

How’s the bonus?

Signing up for the Platinum Select will normally net you 50,000 bonus points, which is respectable but not worth it when, at times like this, you can get 75,000 points after spending $3,500 in the first 4 months after account opening. This, mind you, for a card that waives its $99 annual fee for the first year.

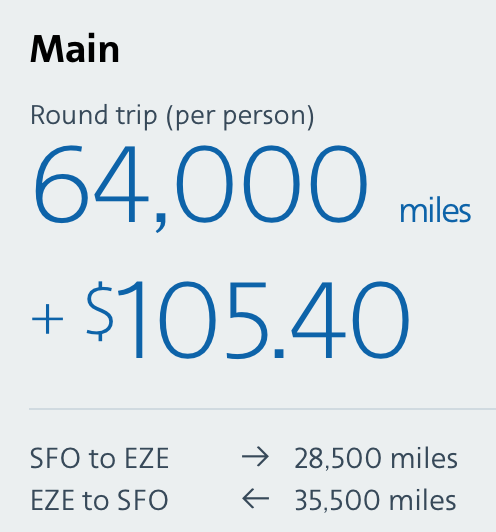

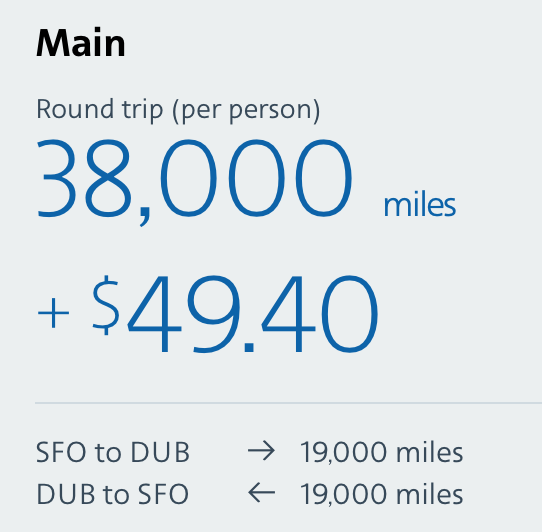

AA miles are incredibly valuable, especially for economy flyers. From my home airport, 75,000 AA miles would be enough for a flight to Tokyo, Buenos Aires, or nearly two tickets to Dublin.

That’s an incredibly efficient way to earn a lot of valuable and otherwise hard-to-earn miles.

What else do you get?

Earning Miles

For the right person this might be a good keeper card. It earns 2x points on AA purchases, gas, and at restaurants. The 2x on gas makes it an above average gas card in its own right. Although there are better cards out there for booking flights (5x with the Amex Platinum, 4x with the Wells Fargo Autograph Journey, 3x with the Chase Sapphire Preferred, Citi Premier, and Amex Green and Gold) or dining out (4x with the Amex Gold, 3x with most Chase cards, the Bilt Mastercard, Citi Premier, and others). But with the AA cards now being the only way to earn AA points via card spending, the 2x rate is reasonably competitive and you could justify using the card.

Airline Perks

Like most co-branded competitors, the Platinum Select will get you priority boarding, a free checked bag (for you and up to 4 traveling companions), and a 25% discount on in-flight food and drinks. With baggage fees skyrocketing, the free checked bag could pay for the cost of the annual fee quickly if you ever need to fly AA and check a bag. The miles you earn on the card also earn you Loyalty Points toward AA status if you’re inclined to try to earn that.

Other

The card comes with World Elite Mastercard benefits and protections and has no foreign transaction fees. You’ll also have access to Citi Merchant Offers for opportunities for additional savings with certain merchants.

How does it compare to the Aviator?

Until recently, I would have said the Aviator was a better card. That was because the Bilt card earned equal or more points–which could become AA miles–than both cards on every purchase, so there was no reason to ever actually use the AA card. That being the case, the more important comparison was the perks, and I thought the $25 credit toward in-flight wifi on the Aviator was more valuable than anything the Platinum Select offered.

Now, though, the Platinum Select’s double miles at restaurants and gas stations makes it the best way to actually earn AA miles, and I’m inclined to recommend the Platinum Select to most people who are looking for an AA card–at least in the abstract. Of course, that tiny point-earning difference pales in comparison to the current 25k-mile gap in the welcome offers of these cards. Focusing on the best bonus is almost always the best way to go, and the current bonus on the Platinum Select makes it an easy choice.

Conclusion

With Bilt out of the picture, the Platinum Select is now the best way to earn AA miles, especially when the welcome offer is so attractive. If you have a chance to get the card with the 75k mile bonus and it makes sense for your financial situation, I think it’s one of the better opportunities out there to boost your travels.